Credit card on web and mobile: service design and usability

For: Kroger Credit team / 2023 / My role: Product Designer, Researcher

Quick Summary

Overview

Though it had potential, Kroger’s credit card product was struggling to meet its customer numbers. Our team used a service design approach to review the end-to-end process to create a proposal for a more visible, usable credit product.

role

Product Designer, Researcher

Responsibilities

Research, Artifact creation, Strategy, UI& Prototyping

collaborators

Design team, Business, Product Management

duration

1 year

Goals

Define a modern and strategic future state for the credit product, integrated with Kroger’s loyalty program

Create an MVP plan for a new credit product

Increase household % of credit card users

RESULTS

$100M projected 10-year ROI

10% revenue growth during this time period

110+ touch points identified

Detailed case study

Challenge

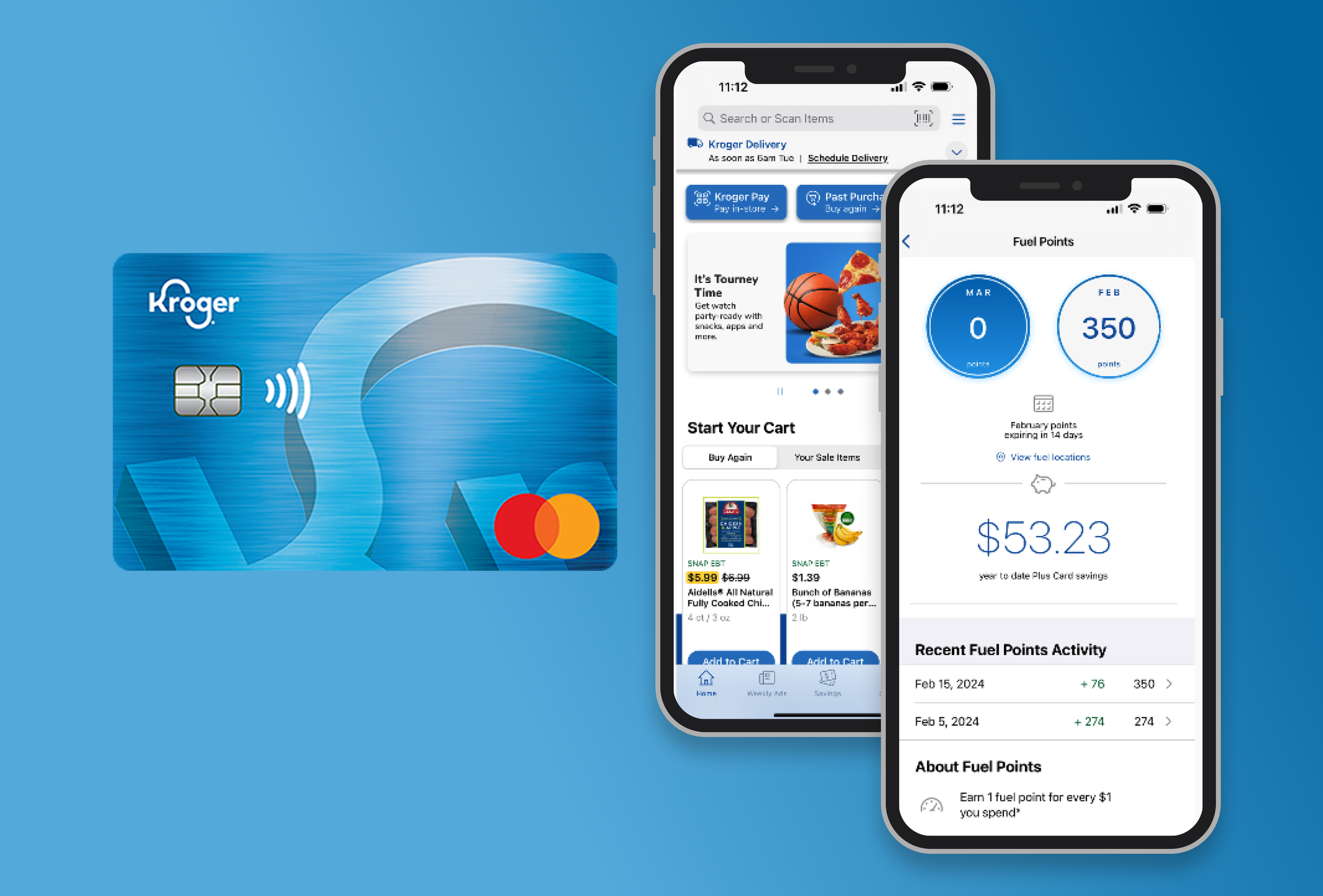

Although Kroger’s credit card (powered by US Bank) product had the potential for high revenue, its customer adoption was low. This was partly because of the poor discoverability of the web & mobile application, and generally poor user experience that felt short of customers’ expectations.

Goals of this project:

Understand the end-to-end experience of the credit card product and identify opportunities

Create strategies for increasing visibility of the credit card product

Create artifacts to document current & future customer flows and service touchpoints

Discovery

Research goals:

Understand the current end-to-end user flow of the credit card application

Identify pain points and opportunities to reduce friction in overall experience

Research activities:

Created service blueprint of applications and where they overlap with other services / systems

Created user flow and journey map of web and mobile applications

Expert interviews with key SMEs to understand the backend processes for the application

research

Gathering Insights

A brief competitive review revealed that Kroger’s credit card product was falling short of competitors’ due to poor discoverability and vague offerings.

Competitor review

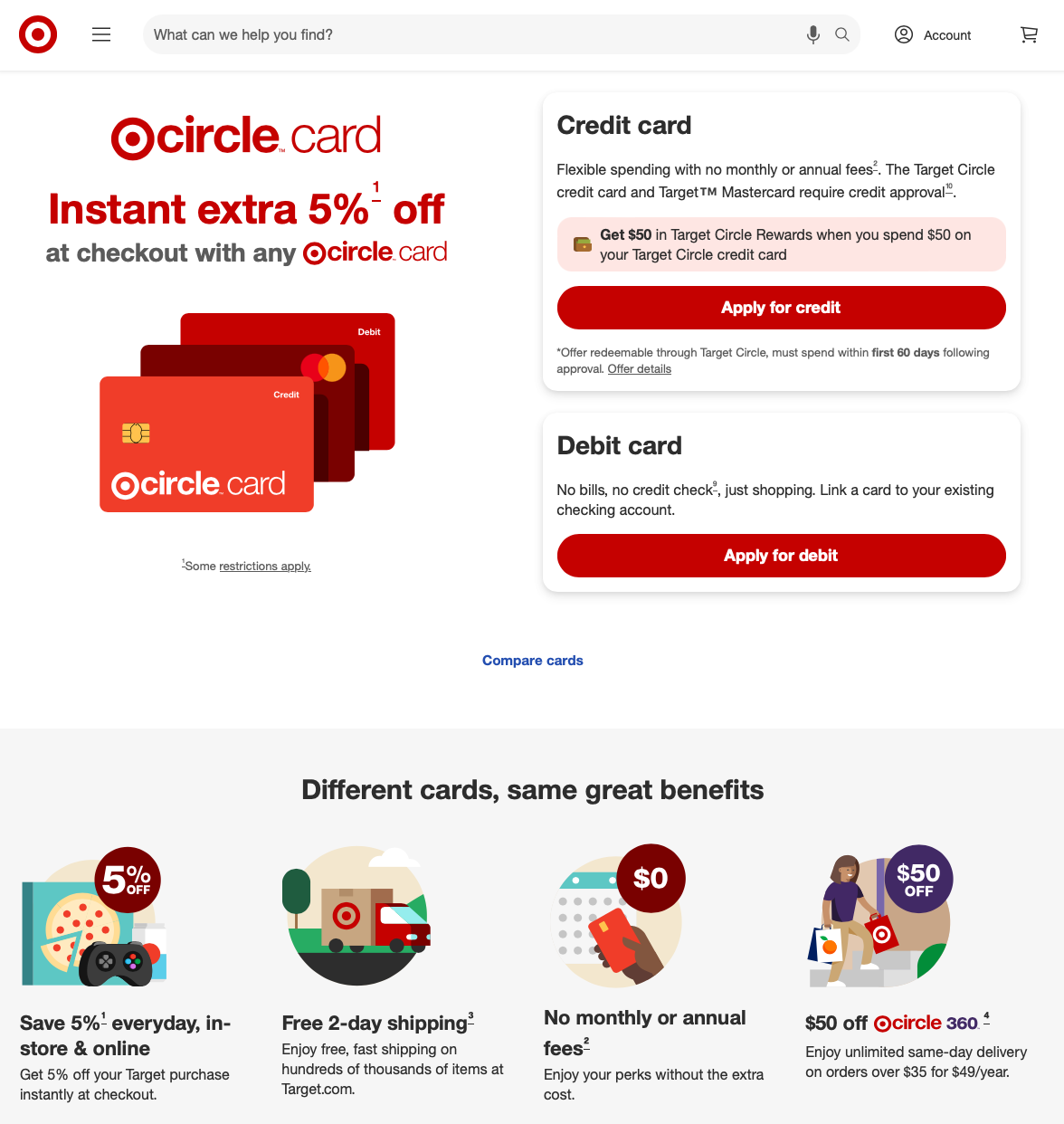

We looked at several competitors’ websites and took note of how they market their credit product.

Competitor HEB had information about the credit product in a very visible part of the site.

Walmart also displays the credit product in a prominent way.

Kroger: the credit card visual is shown, but at the very bottom of the website, with poor discoverability.

Target has a very clear, easy-to-remember offering of “5%" off,” with a presence everywhere in the website.

Kroger: there is no marketing on the front page about the credit product.

Kroger was noticeably falling behind on visibility, with very minimal credit information on the retail website, when our competitors used prominent placing for theirs.

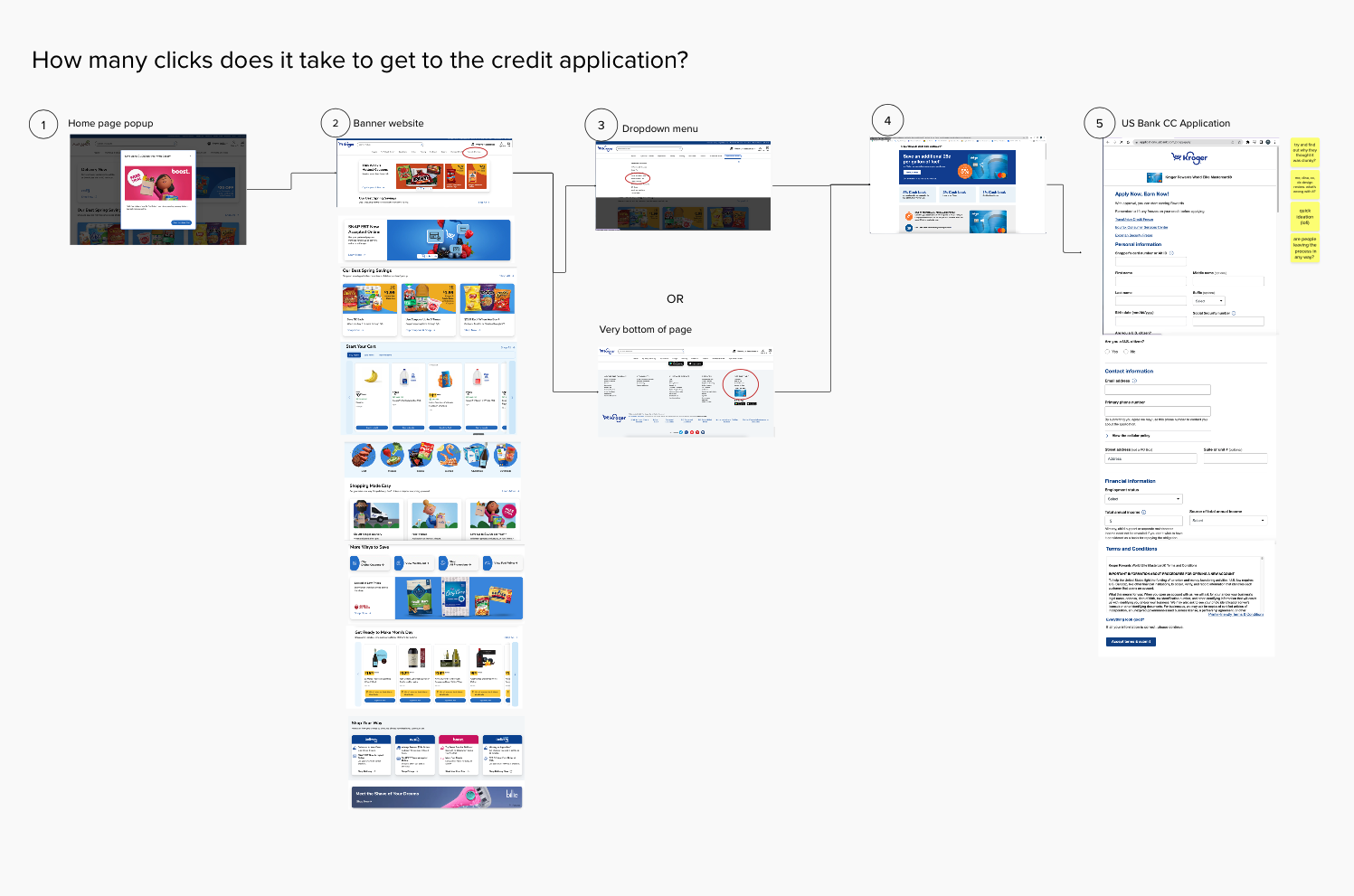

Enrollment process Review

We also reviewed how many clicks it took for a prospective customer to get to the Kroger credit application. It took 5 separate clicks, which was too many by current standards.

Emerging Themes

Here are the themes that came up in competitive research, and influenced our design choices.

Discoverability of product: Customers need clear, highly visible marketing to learn about the product. Our competitors used high-value spots on their front pages to highlight their credit offerings.

Clear, memorable offerings: Several competitors have one-liner offerings — “instant 5% off your order”, or “5% cash back.” These offers are easy to remember and consider.

Modern, trustworthy mobile experiences: There was a clear need for the mobile experience of managing the card to inspire trust and be frictionless, since customers are used to high-level technology and safety functions from bank mobile apps.

Product Strategy

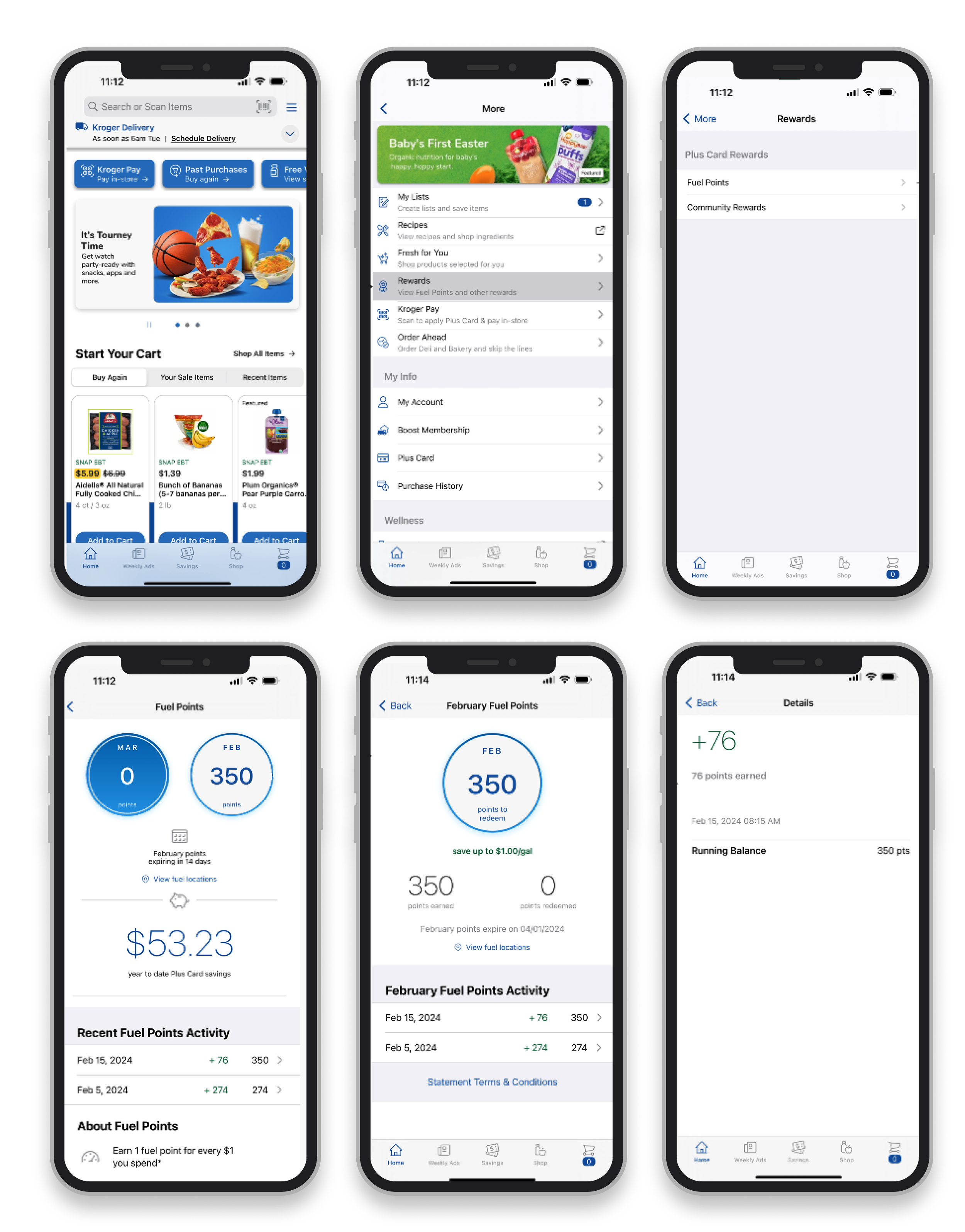

Kroger Plus is Kroger’s well-liked loyalty point system, which is redeemable as a discount at participating gas stations.

Since the credit product needs better recognition and visibility, we decided to integrate the credit card product with the existing loyalty point system.

Defining the Future State

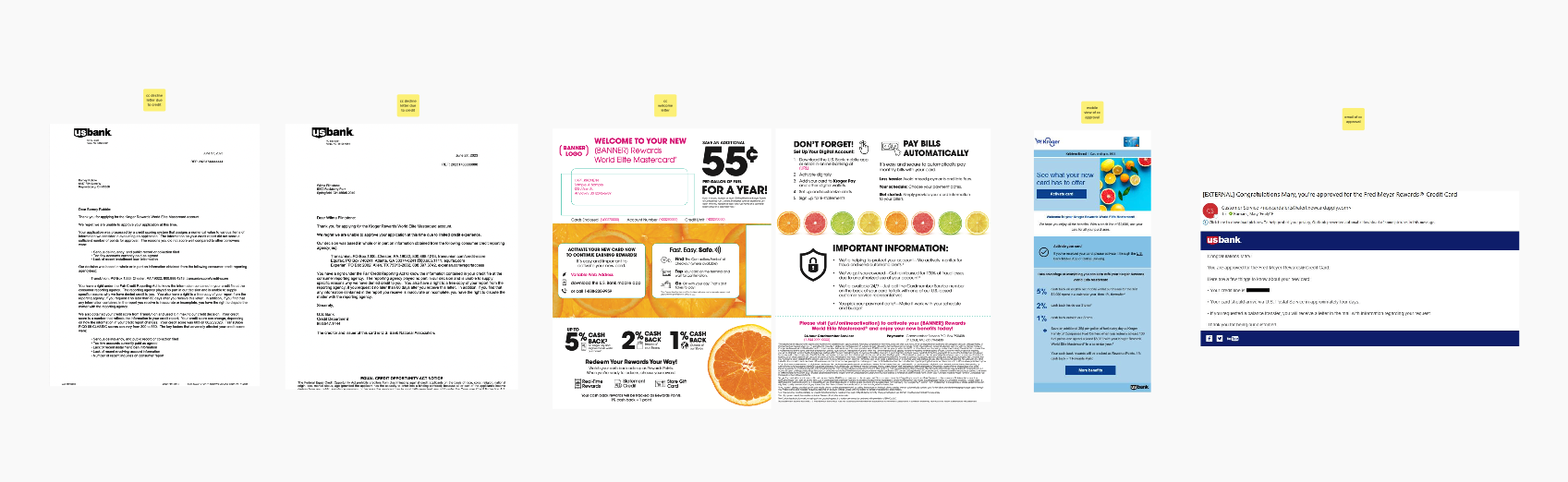

We created several artifacts when determining our future vision.

Ideal future customer journey map

Ideal future service blueprint

Customer persona

User flow of the future state app

We based these decisions on customer interviews, expert SME interviews, usability reviews, and competitive research.

Service Blueprint

Users & Personas

Credit customer persona

Ideal Future State Customer Journey

Ideal future state customer journey

Researching Back-End Integration

Kroger Credit was powered by US Bank; if the future of Kroger Credit was to integrate with Kroger Plus, we needed to do some serious technical research into how those two systems would speak to each other.

First, we spoke with the Engineering team on Kroger Loyalty to figure out how special status could be applied to Credit customers within the loyalty system, and created this diagram as a part of our conversation:

Contents blurred due to company requirements.

Our Focus

Create a modern, trustworthy system that integrates the well-known Kroger loyalty points with the Kroger credit card.

Low-Fidelity Wireframes

Before creating a full high-fidelity prototype, we created and tinkered with several rounds of low-fidelity wireframes to get the experience just right.

We focused on connecting the regular loyalty points (from purchases with loyalty card) and credit-exclusive points/offers, while keeping them distinct from each other.

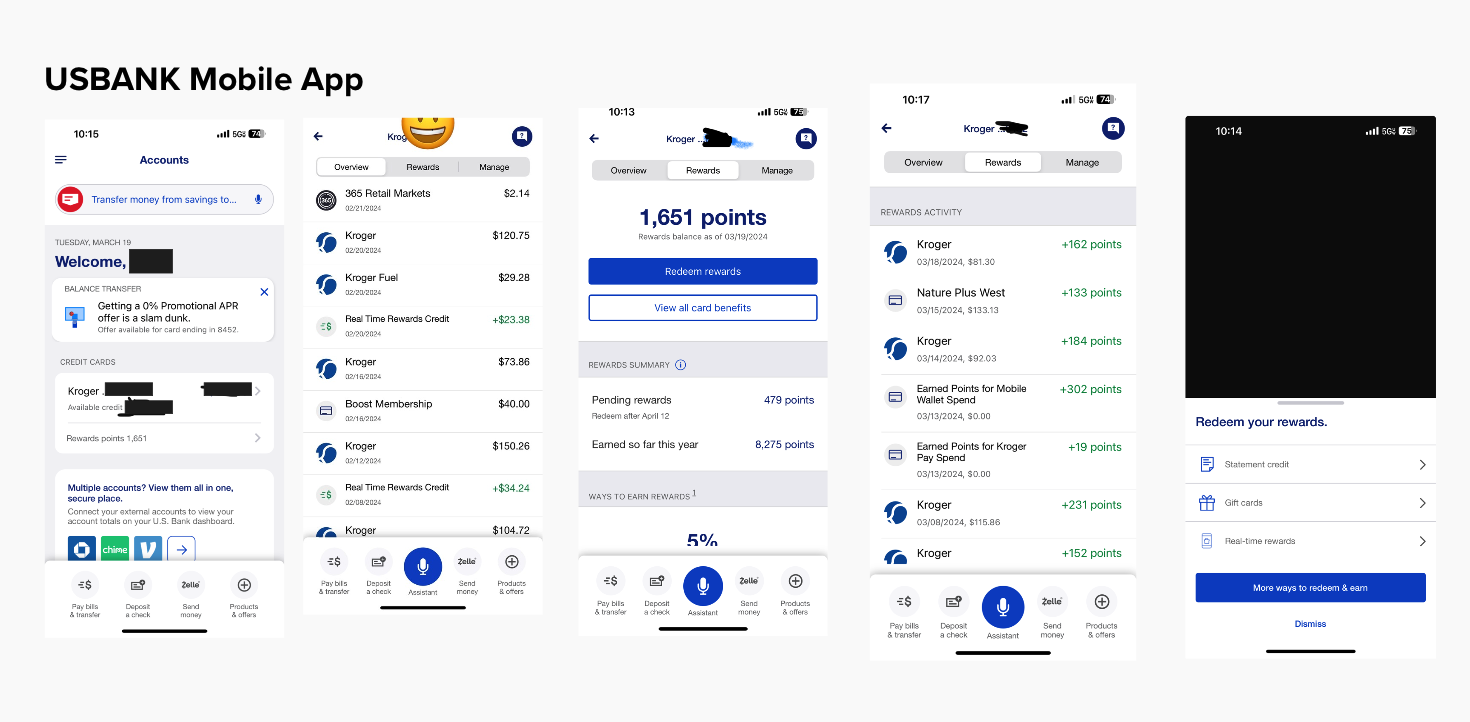

We modeled our flow after the US Bank mobile app (which powers the Kroger Credit card) in order to ground the experience in a familiar and trustworthy flow.

A flow from US Bank Mobile app - we modeled our Kroger Credit’s mobile experience off of this experience.

The Final Pitch

Impact & Outcomes

Here’s how we made progress toward company goals during this project:

$100M projected 10-year ROI, estimated by the business team

10% revenue growth during the time I was on the Credit team

110+ touch points were identified within our Credit future planning.

At the end of this effort, we made the following progress towards our goals:

We pitched this future version of the Kroger product to executive-level decision-makers, and our proposal was met with enthusiasm.

We laid the groundwork for a modernized, human-centered experience that will win customer trust and delight.

We started moving towards a more cohesive user strategy across the entire credit card experience, starting from when a customer first learns about the credit product.

Filled the gap in our current understanding of the credit experience (most of these had no documentation at all!), allowing for future efforts to be more streamlined and informed.